San Diego's vibrant coastal lifestyle and stunning scenery attract many homebuyers seeking their dream properties. But navigating the competitive real estate market can be challenging, especially for first-time buyers. Luckily, Federal Housing Administration (FHA) loans offer a pathway to homeownership that makes achieving your San Diego dreams more attainable.

These government-backed loans require lower down payments and credit scores compared to conventional mortgages, making them an attractive option for aspiring homeowners. With an FHA loan, you can unlock the potential of owning a piece of the San Diego paradise, whether it's a charming bungalow in Pacific Beach or a modern condo with ocean views in La Jolla.

FHA loans extend numerous benefits that set them apart from traditional financing options. They include flexible lending guidelines, enabling borrowers with less-than-perfect credit to qualify. Additionally, FHA loans often have lower interest rates than conventional mortgages, resulting in substantial financial advantages over the life of the loan.

Investigate working with an experienced mortgage lender who specializes in FHA loans. They can guide you through the application process, helping you to obtain the best possible terms and rates for your unique situation.

FHA Loans in San Diego: A Guide to Interest Rates

Purchasing a home in sunny San Diego is a dream for many, but navigating the mortgage landscape can be challenging. For first-time buyers or those with less-than-perfect credit, FHA loans offer a viable option. These government-backed mortgages typically demand lower down payments and lenient credit requirements compared to conventional loans.

To obtain the most advantageous FHA loan rates in San Diego, it's essential to carefully compare offers from multiple lenders. Don't hesitate to speak with mortgage professionals who specialize in FHA loans. They can guide you through the process, detail the different loan programs available, and help you in finding the best fit for your financial situation.

- Shop around and compare rates from several lenders

- Get pre-approved for a mortgage to understand your buying power

- Work with an experienced mortgage broker familiar with FHA loans

Remember, grasping the intricacies of FHA loan rates in San Diego can make all the difference in your homeownership journey. By taking the time to investigate your options and seeking expert advice, you can position yourself up for success.

Leading FHA Lenders in San Diego: Find Your Perfect Match

Navigating the home buying process can be a challenging experience, especially when you're looking at get more info an FHA loan. Luckily, San Diego boasts a robust network of lenders who specialize in these government-backed mortgages. To help you trim your options and find the ideal lender for your needs, we've compiled a list of the leading FHA lenders in San Diego.

When choosing an FHA lender, consider factors such as interest rates, loan terms, customer service, and reputation. Reading online reviews and evaluating offers from multiple lenders can help you achieve a smart decision.

- Be aware that FHA loans require mortgage insurance premiums, which add to the overall cost of your loan.

- Explore different lenders carefully before making a decision.

- Consider reaching out to multiple lenders for quotes and compare their offerings.

Perks of FHA Loans for San Diego Homebuyers

Purchasing a home in sunny San Diego can be quite demanding, especially with rising rates. However, FHA loans present an excellent solution for many aspiring homeowners. These government-backed loans are designed to enable homeownership more affordable by requiring lower down payments and lenient credit guidelines. This means that even buyers with restricted savings or not ideal credit can meet the criteria for a mortgage in San Diego's thriving real estate market.

FHA loans also offer perks such as lower loan costs, which can generate significant savings over the life of the loan. Additionally, FHA loans have a simplified approval process, often culminating in faster closings. With these features, FHA loans can be a valuable tool for San Diego homebuyers looking to achieve their dream of owning a home.

Navigating FHA Loans in San Diego

Planning to buy a home in sunny San Diego but facing monetary challenges? An FHA loan could be the perfect solution for you. These government-backed mortgages are designed to make homeownership reachable even with a lower credit score. This overview will walk you through the fundamentals of FHA loans in San Diego, helping you understand their terms and conditions.

- Understand about the standards for being eligible for an FHA loan in San Diego.

- Delve into the benefits of choosing an FHA loan over other financing choices.

- Identify approved lenders in San Diego to start your loan application process.

Obtain the expertise you need to make an informed decision about financing your dream property in San Diego with an FHA loan.

Smart Move: Choosing an FHA Loan in San Diego

Thinking about buying a property in sunny San Diego? An FHA loan could be the perfect solution for you. These government-backed loans offer relaxed qualifying guidelines, making homeownership more attainable even with a lower credit score or limited down payment. With an FHA loan, you can acquire the access to your dream condo in one of California's most desirable cities.

- FHA loans allow for minimal down payments, making homeownership within reach

- Lenient credit score standards

- A diverse selection of residences are eligible

Ready to explore your options? Contact a reputable FHA lender today and uncover if an FHA loan is the smart choice for you in San Diego.

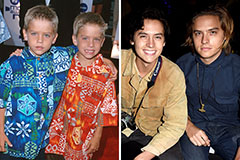

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Lucy Lawless Then & Now!

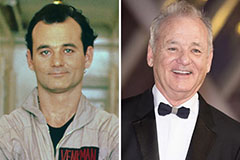

Lucy Lawless Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!